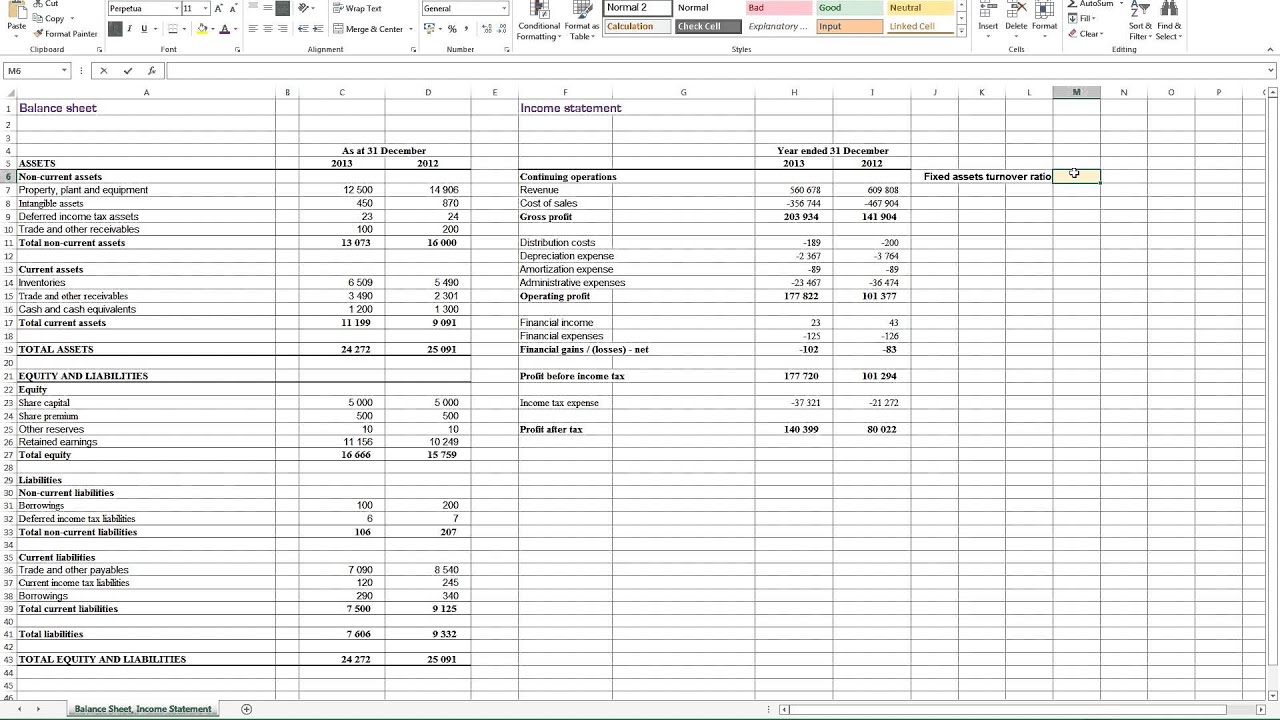

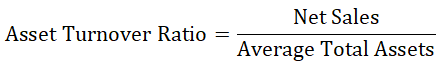

Over time, positive increases in the turnover ratio can serve as an indication that a company is gradually expanding into its capacity as it matures (and the reverse for decreases across time).Ĭompanies should strive to maximize the benefits received from their assets on hand, which tends to coincide with the objective of minimizing any operating waste. High Asset Turnover Ratio ➝ Suggests the company is allocating capital and deriving more benefits from its assetsĬomparisons of the ratio among companies are going to be most meaningful among those within the same vertical or industry, and setting the parameters to determine what should be considered “high” or “low” ratios should be made within a specific industry context.Low Asset Turnover Ratio ➝ Often indicates excess production capacity or inefficient inventory management.The asset turnover ratio is most helpful when compared to that of industry peers and tracking how the ratio has trended over time. Irrespective of whether the total or fixed variation is used, the asset turnover ratio is not practical as a standalone metric without a point of reference. Hence, it is often used as a proxy for how efficiently a company has invested in long-term assets.Ĭonsidering how costly the initial purchase of PP&E and maintenance can be, each spending decision towards these long-term investments should be made carefully to lower the chance of creating operating inefficiencies. The ratio is meant to isolate how efficiently the company uses its fixed asset base to generate sales (i.e., capital expenditures). The formula to calculate the total asset turnover ratio is as follows.

If you are assessing another company’s financials or attempting to determine the right amount of capital to allocate for your business, you can obtain the most useful information by comparing your company’s ratio to that of industry peers.Īdditionally, you can track how your investments into ordering new assets have performed year-over-year to see if the decisions paid off or require adjustments going forward. The turnover metric falls short, however, in being distorted by significant one-time capital expenditures (Capex) and asset sales. In other words, this company is generating $1.00 of sales for each dollar invested into all assets. Unless specified otherwise, the asset turnover metric answers the question, “How much in revenue does the company generate per dollar of assets owned?”įor instance, if the total turnover of a company is 1.0x, that would mean the company’s net sales are equivalent to the average total assets in the period.

Generally, the higher the asset turnover ratio, the better, as this suggests that the company is producing more sales per dollar of asset owned (i.e., faster conversion into turnover, or revenue), and is an indication of being better at putting its assets to use.

#Asset turnover ratio formula youtube free

If management’s operating capital spending has been inefficient, the company is most likely losing out on potential sales due to the misallocation of capital, which will eventually show up on its financials via lower profitability and free cash flow. The asset turnover ratio is calculated by dividing the net sales of a company by the average balance of the total assets belonging to the company (i.e., the average between the beginning and end of period asset balances).

0 kommentar(er)

0 kommentar(er)